Coronavirus Market Update

Last week, stocks around the world fell sharply as investors digested bad news about the coronavirus and its impact on the global economy. In the U.S., the major indices retreated into official correction territory, having dropped more than 10% from their recent highs.

Source: Statista

This week, in an attempt to contain the economic fallout of the outbreak, the Federal Reserve cut the federal funds rate by 0.5 percent to a target range of 1.00 to 1.25 percent. The unanimous decision by the Fed marks the first emergency rate cut and the biggest one-time cut since 2008, when the financial crisis was in full force.

It is clear that the markets do not like uncertainty and this recent event has led to a huge spike in volatility. At this moment it is unknown how long the coronavirus will last, how far it will spread and the absolute impact on the economy. However, it is important to keep a little perspective.

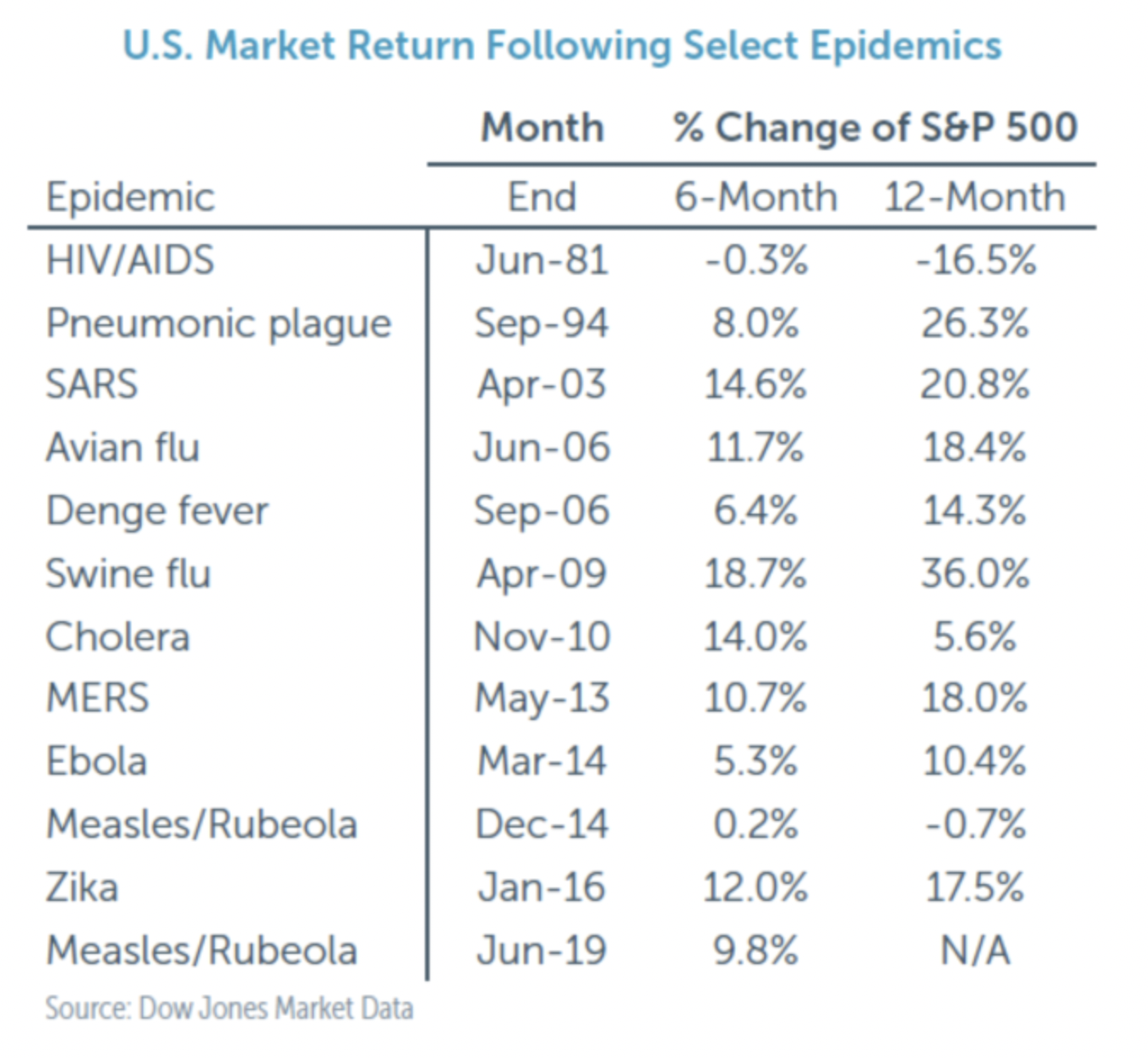

This isn’t the first outbreak that we have had. Over the past 20 years we have seen Sars, Avian Flu, and Zika just to name a few. The markets tend to have short-term memories and typically have been positive within six months to a year following a major outbreak as you can see in the table below.

I know it may sound cliche, but I believe it’s important to mention. As a long-term investor you shouldn’t give in to the temptation of selling your investments to go to the sidelines.

Meticulously constructed investment portfolios can weather almost any economic storm over the long-run. However, the damage can be devastating when an investor panics and sells out based on the latest headline.

You may be thinking, wouldn’t it make sense to go to the sidelines and wait this thing out? This is a logical question, but the reality is that as soon as there is any positive information, the market typically bounces back up.

Unfortunately, it’s almost impossible to predict when the market will turn and trying to get the timing right is a fool’s errand.

Stock market corrections are perfectly normal. Keep in mind, there have been 26 market corrections (not including last week’s) since World War II with an average decline of 13.7%. The recoveries have typically taken four months on average.

So here is some good news. The reality is that even if you happen to be unlucky and catch the virus you will have overwhelming odds of recuperating from it.

According to John Hopkins University, as of Wednesday over 50,000 people have had the ailment and have made full recoveries. Health officials have also indicated that the chances of contracting the virus are fairly low for the average person.

It does have a slightly higher mortality rate than some of the more recent viruses, but if you have a healthy immune system than you most likely have nothing to worry about.

Stay healthy out there!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Patrick Dinan, and all rights are reserved.