Impact Market Update

There is reason to be optimistic that we have turned the corner on the pandemic. And to think it only took one year! In March of last year, we naively thought this whole pandemic thing would only last a couple of weeks or a month!

And it was just one year ago, we were in the midst of a sudden bear market as the S&P 500 quickly sold off 37% from the February peak in 2020 due to the strange virus that we are all so familiar with now.

However, in April 2020, the market snapped back very quickly once the government indicated that they would provide a record-shattering stimulus bill that included forgivable loans to small businesses and $600 a week in payments to the unemployed. The market rallied for the rest of the year and never looked back.

Last year ended up being a banner year for sustainable investing. The sustainable portfolios at Impact Fiduciary returned anywhere from 24% to 43%, depending on the portfolio’s risk level, while the S&P 500 returned 18%. Sustainable investing paid off very nicely as disruptive future trends were accelerated into the present.

Clean Energy vs. Big Oil

The Invesco Solar Index ETF (TAN) alone was up over 230% in 2020, while the fossil fuel energy sector lost 32% for the year. Impact Fiduciary is fully divested from climate change inducing energy and utility companies that profit from dirty fossil fuels, instead investing in clean energy technology.

2021?

This year has started out with more of a thud than a bang. Right now, the market is flat to negative for the year, as we’ve seen an uptick in volatility. You might ask why the market would be flat if there is such good news coming out about the economy reopening and the risk of the virus subsiding.

The reason is that the market is forward-looking. A lot of the good news has already been digested and priced into equities. We saw a major leg up last year when the vaccines were approved for distribution and it was clear we were going to get a new administration in the White House. The market prices reflected the light at the end of the tunnel.

Interest Rates Have Jumped

Recently, we’ve seen an uptick in market volatility as interest rates have sharply increased. The interest rates on treasuries were at record lows for the latter part of last year. We’ve recently seen the ten-year treasury yield spike from 0.9% to 1.59% in just a couple of months.

When rates on bonds go up, there’s an inverse relationship to the price of existing bonds paying a lower interest rate which can cause bond ETFs and mutual funds to decline in value. This can also put downward pressure on the price of stocks because bonds become increasingly more attractive thus pushing some investors to sell stocks and buy more bonds in the short-term.

The increase in rates can be the market signaling that inflation is on the horizon and the Federal Reserve will increase the Fed Funds discount rate sooner rather than later.

So why does this matter? There is a very strong correlation between the interest rates charged on mortgages, business loans and credit cards and the ten-year treasury bond. Basically, as the ten-year treasury yield increases so does the cost of borrowing money and doing business.

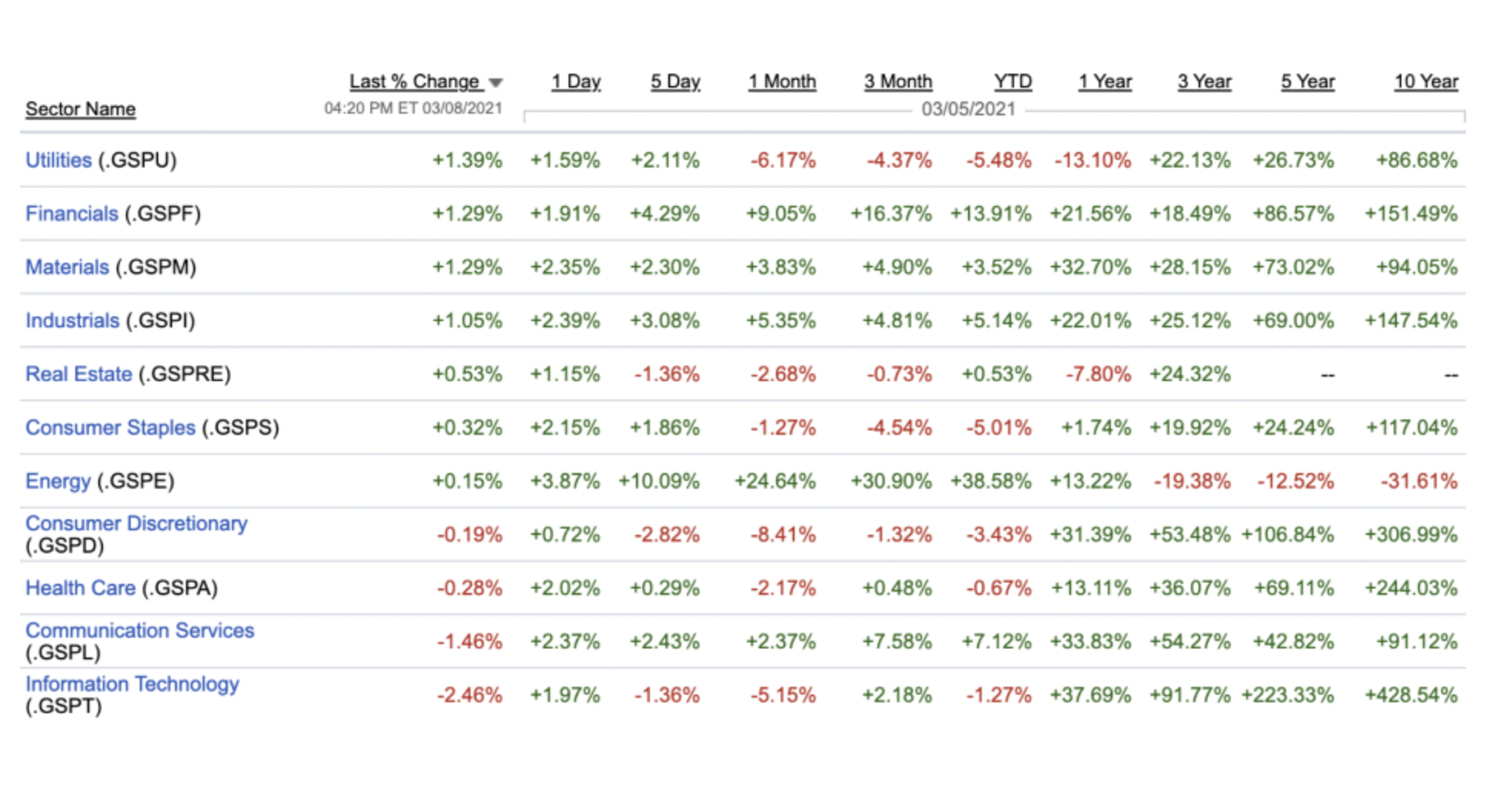

Sector Rotation Into Value Stocks

This can especially affect stocks in more sensitive sectors such as consumer cyclical and technology. We’ve recently seen a rotation into more value-oriented sectors.

Value stocks tend to be companies and business models that have predictable cash flows and tend to pay higher dividends. This includes the fossil fuel energy sector, financial services, industrials and basic materials.

The Empire Strikes Back

Unfortunately, one area that has done well this year is the fossil fuel energy sector, which has led the market with a 38% return so far this year.

Impact Fiduciary doesn’t have exposure to the fossil fuel energy sector so we haven’t participated in the recent upside. However, I believe the secular decline of energy companies is still intact and that sector’s recent gains will be short lived, as alternative energy will win over the long-run.

Regardless, I would prefer not to profit from the destruction of Mother Earth and instead invest in companies trying to solve the climate crisis.

Is This a Market Bubble?

Are we currently in a market bubble? It’s hard to say. Bubbles are difficult to discern until they have popped. However, I don’t necessarily believe that we’re in a bubble right now, because bubbles are usually marked by extreme optimism and euphoria. Everyone plows every last dollar they have into the market.

In fact, up until recently, retail investors were actually lowering exposure to stocks as equity or stock funds were showing net outflows, not inflows.

However, I do believe that there is some complacency in the market right now. We all watched the drama unfold as Robinhood traders successfully inflated the value of GameStop and a couple of other value companies to nosebleed levels.

The GameStop saga has been entertaining to watch but most likely won’t end well for the participants. The market fundamentals will eventually bring the stock back to earth and the majority of the participants will lose.

Trading = Gambling

In fact, multiple studies have shown that most active traders, like gamblers at a casino, tend to lose most of their money over time. This is because active trading is just glorified gambling.

Just like gambling at a casino, you might have some lucky trades. But the longer you stay at the table, the better the chance you have of giving your gains back to the house or in this case the market. At least in Vegas you get free drinks!

Diversification & Rebalancing Works

Diversification is admitting that you can’t predict the future. This is why Impact Fiduciary uses a systematic approach to investing. Instead of betting on a handful of companies or sectors, our portfolios are extremely well diversified. The goal is to buy great sustainable companies and hold them for the long-run.

One of the hardest things to do as an investor or trader is to take gains from positions that have done well. This is where greed can kick in and this is why rebalancing is so important. Rebalancing forces you to trim areas that have outperformed, while buying into areas that have lagged behind or may be selling at a discount. Rebalancing prevents you from becoming overexposed to one area of your portfolio.

Don’t Stop Believing!

I’m naturally an optimistic person. However, I believe that it’s invaluable to mentally prepare for the worst outcomes so that, when they happen, you aren’t caught off guard and end up making emotional decisions.

As always, I can’t stress the importance of having a long-term perspective when it comes to investing. Don’t worry about short-term volatility. Zoom out and focus on the big picture. You will be rewarded for your patience.

Say we happen to be in a bubble and the market has a big decline. Then what? If we use history as a guide, we’ve learned from past downturns that the market eventually bounces back. It might take a little longer to reach your financial goals, but just as the Journey song goes, “The movie never ends / It goes on and on and on.” Don’t stop believing!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Patrick Dinan, and all rights are reserved.