Impact's Mid-Year Update: Markets and Sustainability

It's hard to believe we are more than halfway through 2018! So much has happened and the markets have been exciting to watch (at least for me). Today I'll recap some of the more interesting developments and shine a spotlight on an important area of sustainable investing.

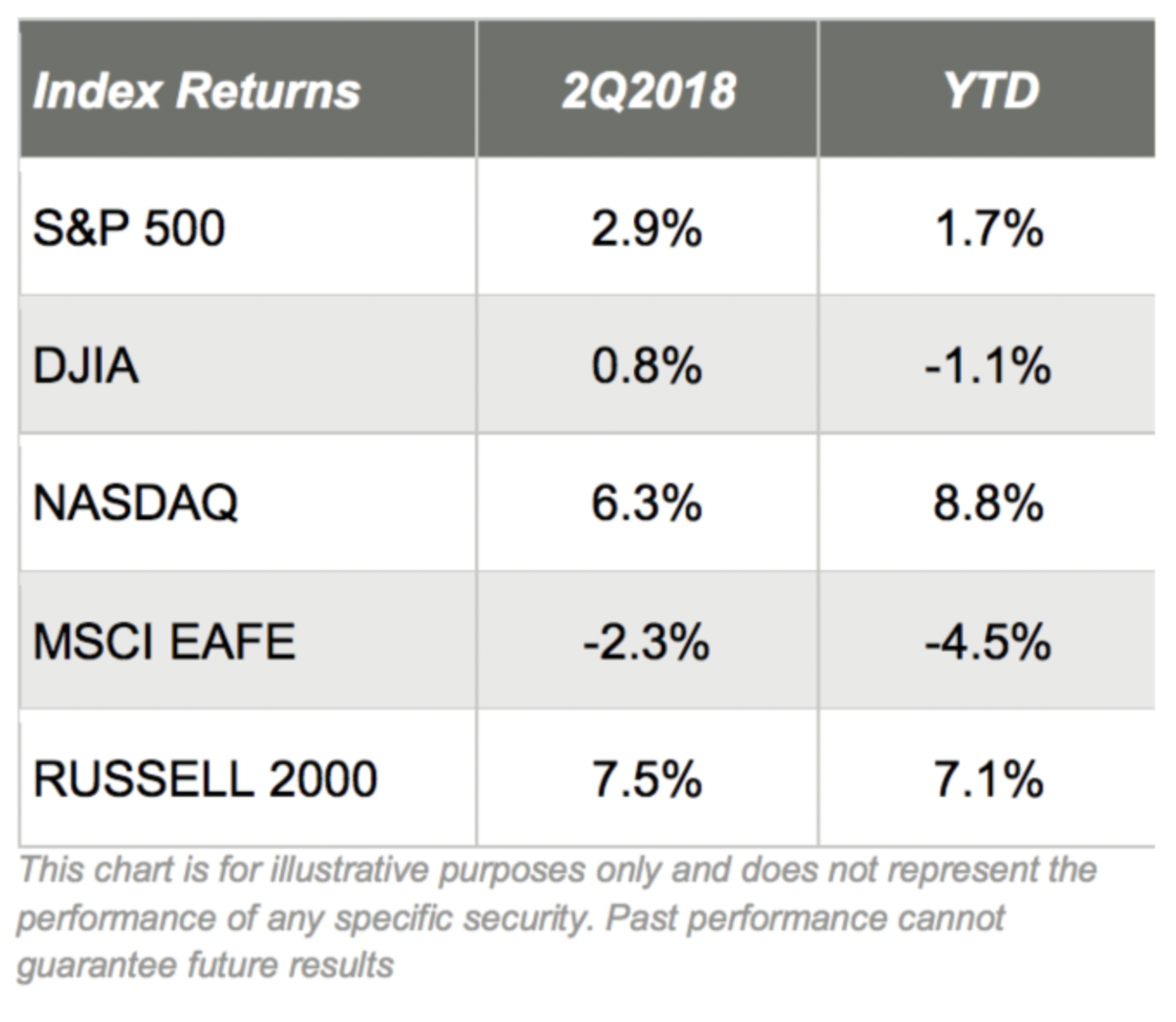

On the heels of most equity markets being down in the first quarter of 2018, the U.S. equity markets recovered nicely during the second quarter. International markets (MSCI EAFE), on the other hand, didn’t fare nearly as well. We'll dig into the reasons below.

Amazon, Netflix and Microsoft

According to a recent CNBC report just three stocks, Amazon, Netflix and Microsoft, have dominated the returns of the S&P 500 this year. In fact over 70% of the S&P 500 returns year-to-date are driven by these companies. And if you add Apple and Facebook they account for almost all the returns. Not owning these names has led to some serious frustration and underperformance against the popular index.

In some ways this feels similar to 1999 when the S&P 500 was up 19.5%. Only a handful of stocks drove the index higher and there were more individual losers than winners in the index for the year. Check out this article from the NY Times published in January of 2000: THE YEAR IN THE MARKETS; 1999: Extraordinary Winners and More Losers

Fixed-Income Markets

In fixed-income land (bonds), interest rates continued to move upward, in line with the Fed’s second interest rate hike of 2018 in June. The Bloomberg Barclays U.S. Aggregate Bond Index (investment grade U.S. bonds) returned -0.2% and is down -1.6% for the year. The market is pricing in one or two more hikes before the end of the year.

Sector Returns

For the 2nd quarter, seven of the S&P 500 sectors were in the green and four were in the red. Energy, Consumer Discretionary and Information Technology were the strongest performers while Industrials, Financials and Consumer Staples lagged behind.

Trade Wars

The president's proposed tariffs on China went into effect at the end of the second quarter. China predictably responded with tariffs of its own, targeting U.S. imports including soybeans, aircraft and autos.

No one will debate that trade worries weighed on the global economy. In general, the markets outside the United States were most affected, especially in China and emerging markets. European equities were also affected, with auto companies suffering on fears that US tariffs could be applied to car imports.

History has shown that trade wars rarely end well. The last major one was in 1930 when congress passed the Smoot-Hawley Act which historians believe made the Great Depression even worse. This could easily be the catalyst for sparking a recession or a bear market.

Oil Prices Rebound

Simple supply and demand economics saw oil prices rise in June as the supply of domestic crude dropped by almost 10 million barrels in the third week in June, according to the U.S. Energy Information Administration. That supply drop also happened to be the largest weekly drop of the year.

Oil prices have been rising due to increasing global demand and as a response to sanctions on sales of Iranian oil.

Solid Economic Data Points

U.S. GDP came in at a 2.0% annualized rate for the first quarter of 2018 (information is reported in the second quarter); and this was slightly below the expected rate. Even so, the economy is now in its 9th year of expansion, the 3rd longest on record.

The jobs market stayed strong and the current unemployment rate has fallen to 3.8%. The housing market is mostly mixed as year over year home sales were flat while home prices were up 5.6% from the preceding year.

Can the first half predict the second half? The short answer is no, however:

Since 1950, when the S&P 500 was positive at the mid-way point, the market was higher for the entire year 94% of the time.

In years when small-caps were positive and leading large-caps – as is the case now – the S&P 500 finished the year higher 83% of the time.

Keep an Eye on the Yield Curve

Interestingly, the yield curve has historically been a good indicator of a coming recession when it inverts – the shorter end moving above the longer end. But as of the mid-way point, most economists believe that the Fed won’t do anything to push the yield curve to invert. The curve does seem to be flattening, pointing toward financial conditions and global liquidity tightening overall. Clearly both would have implications for the markets around the globe and are worth keeping an eye on.

The Energy Sector and Sustainability

Sustainability is at the crux of Impact Fiduciary's investment strategy. Our goal is to invest in earth-friendly, mission driven companies and industries that are disrupting the status quo instead of being disrupted.

At Impact Fiduciary we completely avoid the fossil fuel dominated energy sector and most utilities. Instead we invest in companies harnessing alternative energy technologies such as solar, geo, hyrdro and wind. This has impacted our relative performance since the fossil fuel energy sector has been performing so well this year. Keep in mind that the energy sector is still one of the worst investments over the past five years.

From a broad sustainability standpoint higher oil prices are both good and bad. Higher oil prices make earth friendly alternatives like solar and wind much more cost competitive without subsidies. It also makes electric cars much more compelling to consumers when paying $4 per gallon of gas versus the electric car equivalent of $1 or less a gallon.

In the short run this is a great way for solar companies and electric cars to become more popular. From an investing vantage point I believe that the higher the fossil fuel company stocks go the harder they will fall as the exponential technologies like solar, battery storage and other alternatives reach a tipping point and completely steal away market share. The timing is hard to predict but I believe it will be in the next five to ten years.

Reminder: Too much carbon dioxide is bad for the earth. This is why we need fossil fuel extraction companies to get disrupted. Source: NASA

Invest in a Better Future

Impact Fiduciary is proud to have a meaningful position in the solar industry. Unfortunately, this year solar companies haven't fared as well as the market. The current administration, not surprisingly, has been very kind to the fossil fuel industry, while imposing tarrifs on solar panels.

However, progress marches forward. The tarrifs and this administration won't last forever. And we've seen the boom and bust nature of the oil markets over the past decade.

The Trillion Dollar Opportunity

Solar is an exponential technology that has continued to gain market share every single year. The cost has decreased by a whopping 50% in the past 5 years and 10% a year for over 40 years! Battery storage is now 79% cheaper than a decade ago. (Source: the 2018 Bloomberg New Energy Finance Outlook)

These trends are gaining speed not slowing down. I'm optimistic that we could see one of the biggest economic shifts in our lifetime over the next decade. Instead of worrying too much about short-term performance, it's much more important to stay focused on smart diversification and investing in a better future!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Patrick Dinan, and all rights are reserved.